Ftx 2.3b

The recent valuation of Ftx 2.3b serves as a significant indicator of its position within the volatile cryptocurrency landscape. This figure not only reflects the company’s diverse revenue streams and user engagement but also highlights the pressing need for adaptability in the face of regulatory shifts and competitive pressures. As stakeholders assess the implications of this valuation, the question arises: what strategies will emerge to navigate the complexities of this dynamic environment? Exploring these considerations may reveal critical insights into the future trajectory of both FTX and the broader crypto market.

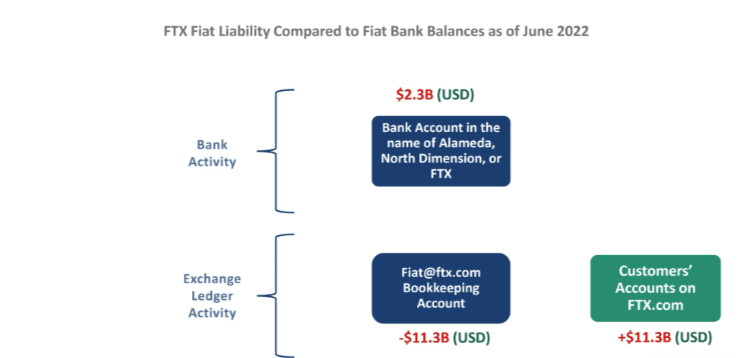

FTX’s Valuation Breakdown

As FTX navigates the complexities of its valuation, it becomes essential to dissect the various components that contribute to its financial standing.

Key valuation factors include revenue streams, user engagement, and competitive positioning within the crypto ecosystem.

Additionally, market dynamics, such as investor sentiment and regulatory developments, significantly influence FTX’s perceived value.

Understanding these elements is crucial for stakeholders seeking informed decisions.

Implications for the Crypto Market

Analyzing FTX’s recent valuation developments reveals significant implications for the broader crypto market.

The substantial valuation shift underscores ongoing regulatory challenges that could reshape trading dynamics and investor confidence.

Heightened scrutiny may lead to increased market volatility as participants navigate these uncertain waters.

Consequently, stakeholders must remain vigilant, adapting strategies to mitigate risks while capitalizing on emerging opportunities within this evolving landscape.

Read Also Filing Riot Platformswynn Theblock

Investor Insights and Lessons

Numerous insights emerge for investors following the recent developments surrounding FTX’s valuation.

Key takeaways emphasize the necessity of robust investor strategies and effective risk management.

Investors must remain vigilant, critically assess market dynamics, and diversify their portfolios to mitigate potential losses.

Understanding the volatility inherent in crypto markets is crucial, allowing for informed decisions that align with individual risk tolerance and investment goals.

Conclusion

In summary, Ftx 2.3b serves as a poignant reflection of the intricate dynamics within the cryptocurrency landscape. The interplay of regulatory developments and market fluctuations will continue to shape investor sentiment and operational strategies. As stakeholders navigate this labyrinthine environment, a prudent approach to risk management and investment will be essential. Embracing adaptability and foresight will enable participants to not only weather the storm but also seize emerging opportunities in a rapidly evolving market.