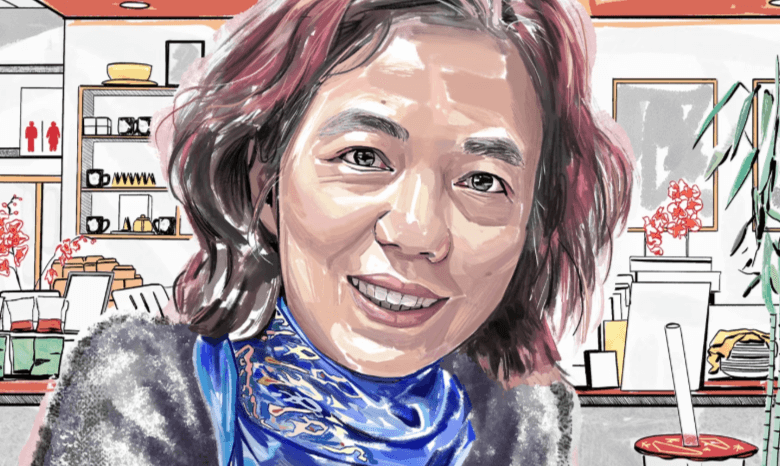

Interview Stanford Feifei Silicon Aihammond Financialtimes

Interview Stanford Feifei Silicon Aihammond Financialtimes featured in the Financial Times, the discussion centers on the pivotal role of artificial intelligence in reshaping the finance industry. Li articulates not only the efficiency gains AI offers but also the pressing ethical challenges that accompany its integration. As financial institutions increasingly rely on AI-driven insights, the conversation raises critical questions about transparency and the need for inclusive practices. What frameworks can be established to ensure that these technological advancements serve a broader societal purpose? The implications of her insights warrant further exploration.

AI’s Impact on Finance

The integration of artificial intelligence (AI) into the finance sector has fundamentally transformed traditional practices, ushering in an era marked by enhanced efficiency and precision.

Algorithmic trading leverages AI to analyze vast data sets, enabling rapid, data-driven decision-making.

Additionally, AI-driven risk assessment tools allow financial institutions to evaluate potential threats with greater accuracy, ultimately fostering informed strategies and more resilient financial systems.

Challenges in AI Implementation

Despite the promising advancements AI has brought to the finance sector, several challenges hinder its widespread implementation.

Data quality remains a critical concern, as inaccuracies can lead to flawed decision-making.

Read Also Interview Schiller Apple Eu Fastcompany

Additionally, model transparency is essential for fostering trust among stakeholders, yet many AI systems operate as “black boxes,” complicating the evaluation of their decisions.

Addressing these issues is vital for successful AI integration.

Ethical Considerations in AI

Navigating the ethical considerations in AI is crucial as the technology becomes more integrated into various sectors.

Effective bias mitigation strategies are essential to ensure fairness and inclusivity, while transparency measures foster trust among users.

Conclusion

In conclusion, the integration of Interview Stanford Feifei Silicon Aihammond Financialtimes represents both a beacon of opportunity and a landscape fraught with challenges. As these technological advancements reshape financial practices, the call for ethical stewardship and transparency becomes paramount. Continuous monitoring and stakeholder engagement serve as the compass, guiding the industry towards equitable outcomes. Ultimately, fostering fairness and inclusivity will ensure that AI acts not merely as a tool, but as a catalyst for positive transformation within finance.