Is Credit Score Check A Key To Instant Loan Approval?

Quick loans applied online are a convenient and acceptable choice for most individuals in our digital era. In a time of financial crisis, this approach is practical; It is simple and quick to check credit score. Whether you need the money for an investment, a personal need, or an emergency, these quick loans are changing the banking system.

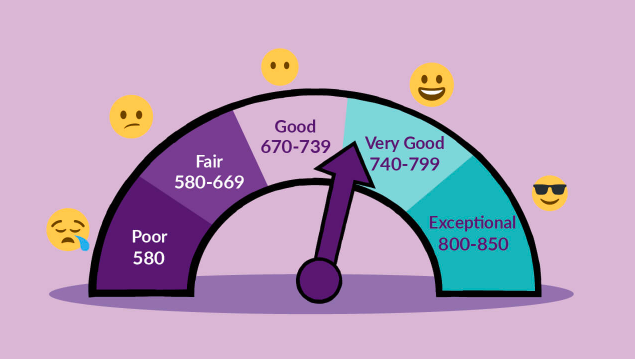

One of the most common ways to get these quick loans online is by using the applicant’s credit score. Lenders could use this credit score to determine whether they would provide the loan amount. Learn the ins and outs of how your credit score affects the approval of an online quick loan; it’s essential, but it could not be very safe.

Seek A Little Loan Sum:

To get a quick loan online without CIBIL, you should apply for a smaller amount. Online lenders are more likely to approve and pay off small loans. Because there are more variables that lenders look at when assessing your creditworthiness and ability to repay the loan in full, they may reject your application for a more significant loan amount.

Put A Surety In Place Before You Apply:

You may usually get a personal loan without putting up any collateral. However, a small loan with a guarantor might be an option for applicants with a poor or nonexistent CIBIL score. Guarantors who are relatives of the applicant, such as parents, siblings, or spouses, may be able to give a higher credit score. Because of this, getting a loan online without a CIBIL check is far more likely.

A Record Of Earnings:

Lenders need income verification when you apply for a loan. Applying for a loan requires you to provide every source of income. Lenders are more likely to accept your loan application if they know you have a steady income and can repay the loan on time, even if your credit isn’t perfect.

It Offers Fast Loans Without Requiring A Credit Record; Why Use It?

Many NBFCs may ask for a CIBIL score when applying for a personal loan app. On the other hand, it offers personal loans even if you don’t have a CIBIL score. You don’t need a CIBIL score when you apply.

Your PAN and Aadhar cards and your other Know Your Customer details are required. You should provide your wage information and bank documents to prove that you can repay the short-term loan even without a strong CIBIL score. It will bolster the applicant’s assertion of financial stability.

This loan may be used for many different purposes, such as weddings, trips, unanticipated medical bills, or even college tuition.

With this, borrowers can apply for small loans online and get instant approval without waiting for a CIBIL check. Before applying for a short-term loan without CIBIL, applicants may use an online personal loan EMI calculator to find out the monthly payment amount (EMI) and pick a length that suits their requirements.

Read also: Leveraging Technology to Streamline Operations in the Hospitality Sector

Personalized Loan For Low Credit Scores

The likelihood of a loan approval increases with a good credit score. Personal loans with low credit scores are still available from specific lenders, but customers may face higher interest rates and fewer lending options. However, for larger loans, your credit score may be required by specific lenders.

One must remember that being eligible for a loan does not guarantee approval just because they meet the minimum standards. There are several qualifying criteria that lenders look at before approving a loan application, one of which is the applicant’s credit history.