Asml Q1 Yoy 6.74b Yoy 1.96b

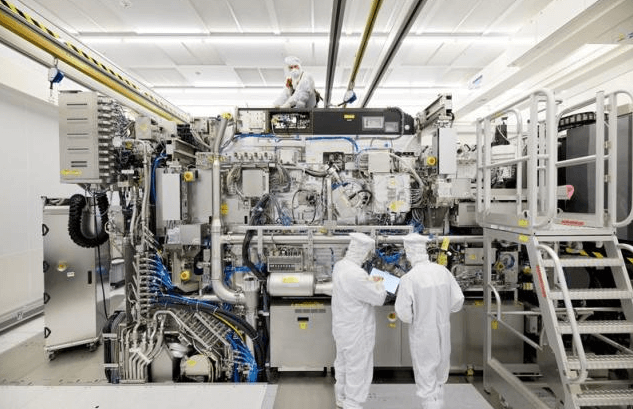

Asml Q1 Yoy 6.74b Yoy 1.96b, underscores the company’s robust financial standing and strategic approach to market dynamics. This surge in figures prompts an intriguing exploration into the factors driving ASML’s exceptional results and its implications for the semiconductor industry as a whole. The correlation between these financial metrics and broader industry trends warrants closer examination to unveil the underlying strategies fueling ASML’s success and potential future trajectory.

Financial Highlights

In the analysis of the financial highlights for ASML in Q1, there was a year-on-year increase of 6.74 billion euros, reaching a total of 1.96 billion euros.

This substantial financial growth reflects positively on ASML’s profitability margins, indicating efficient operations and healthy financial performance.

The company’s ability to enhance profitability while achieving significant revenue growth showcases its strong financial position and strategic management choices.

Revenue Breakdown

The distribution of revenue in ASML’s financial report reveals key insights into the company’s financial performance and market dynamics. ASML’s revenue sources are primarily driven by semiconductor equipment sales, service contracts, and technology licensing.

Diversifying revenue streams through increased service offerings and expanding into emerging markets present growth opportunities. Understanding the breakdown of revenue sources is crucial for identifying potential areas for optimization and future strategic planning.

Market Performance Analysis

Analyzing ASML’s revenue distribution provides a foundation for understanding its market performance dynamics. Market trends and the competitive landscape play crucial roles in shaping ASML’s position within the semiconductor industry.

Read Also Amd Forumlarabelphoronix

Future Projections

Navigating through evolving market conditions, ASML is poised to project future growth and innovation within the semiconductor industry. Leveraging its technological prowess and adaptability, ASML is positioned to capitalize on the industry’s growth potential.

Conclusion

In conclusion, Asml Q1 Yoy 6.74b Yoy 1.96b financial performance exemplifies a meteoric rise in revenue, soaring to 6.74 billion euros year-on-year.

With a diversified revenue stream and strategic market positioning, the company has solidified its profitability margins and operational efficiency.

ASML’s trajectory towards future success is akin to a well-oiled machine, poised to capitalize on emerging opportunities and maintain its upward momentum in the semiconductor industry.