Oktanubank: Oktanubank: Digital Banking Solutions

Oktanubank offers a range of digital banking solutions tailored for both individuals and businesses. Its features include mobile banking, real-time transaction tracking, and customizable notifications, making financial management straightforward. Enhanced security measures, such as biometric authentication, ensure user safety. The platform also streamlines operations for businesses, promoting efficient cash flow management. The implications of these advancements for financial decision-making are significant, warranting further exploration of their impact.

Key Features of Oktanubank

Oktanubank offers a range of innovative features designed to enhance the digital banking experience for its users.

With a focus on mobile banking, it allows customers to manage their accounts seamlessly from anywhere. Users enjoy real-time transaction tracking, customizable notifications, and intuitive interfaces that simplify account management.

These features empower individuals, providing them with the freedom to control their finances effortlessly.

Enhanced Security Measures

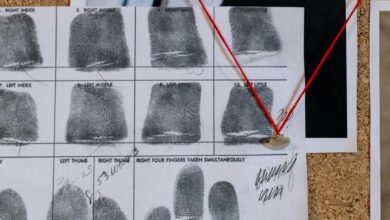

In an increasingly digital world, the importance of robust security measures cannot be overstated. Oktanubank prioritizes customer safety through advanced biometric authentication and cutting-edge encryption technology.

These measures safeguard sensitive information, ensuring that users can engage with their finances freely and securely. By integrating such technologies, Oktanubank builds trust and empowers customers to embrace digital banking without fear of compromise.

User Experience and Accessibility

While navigating the complexities of digital banking, users often seek platforms that prioritize both experience and accessibility.

Oktanubank emphasizes design simplicity, ensuring intuitive navigation that meets diverse user needs. By integrating user feedback into its development process, Oktanubank enhances usability, creating an inclusive environment where individuals feel empowered.

This commitment to accessibility fosters a sense of freedom, allowing users to engage confidently with their banking solutions.

Benefits for Individuals and Businesses

Digital banking solutions offer significant advantages for both individuals and businesses, enhancing financial management and operational efficiency.

For individuals, these tools simplify personal finance management, allowing for easier budgeting and tracking of expenses.

Businesses benefit from streamlined transactions, which foster business growth through improved cash flow and reduced overhead costs.

Conclusion

In a world where financial landscapes evolve like shifting sands, Oktanubank stands as a steadfast lighthouse, guiding both individuals and businesses through the complexities of modern banking. With its innovative features and robust security, users can navigate their financial journeys with confidence, transforming potential pitfalls into opportunities for growth. As the sun sets on traditional banking, Oktanubank illuminates a path toward seamless financial management, empowering users to chart their own course in the ever-changing tide of commerce.